Korean Stock Market Performance and Global Context

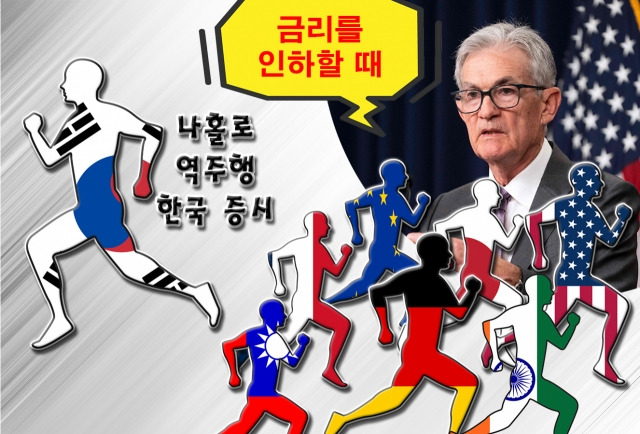

As the U.S. Federal Reserve signals a potential rate cut in September, the global stock markets are experiencing a rally. However, the South Korean stock market, including the KOSPI and KOSDAQ indices, is notably lagging behind. Despite the positive global sentiment, South Korea’s major indices are showing significant declines.

The KOSDAQ index fell by 1.10% and the KOSPI index dropped by 0.68% in the period following the Jackson Hole meeting. In contrast, major global indices such as the S&P 500 and NASDAQ in the U.S., and other European indices like Germany's DAX30 and France's CAC40, have shown positive movements.

Impact of the Korean Won's Appreciation

The rapid appreciation of the Korean won against the U.S. dollar is becoming a concern for the domestic stock market. Over the past month, the won has appreciated by 4.27% against the dollar, making it the third-highest appreciation among G20 currencies, behind the Indonesian rupiah and the Japanese yen.

This strong appreciation is expected to negatively impact the earnings of Korean companies that are heavily reliant on exports. As the dollar weakens, Korean exporters may face reduced profitability, which could adversely affect their stock performance.

Market Sentiment and Export Concerns

Korean securities analysts are worried that the rapid strengthening of the won could be detrimental to the export-heavy sectors of the Korean stock market.

According to Jo Jae-un from Daishin Securities, Korea's high dependence on external demand makes it vulnerable to global economic slowdowns.

The strong won could further erode the profitability of export-oriented companies, impacting their stock prices negatively.

Moreover, the traditional relationship where a stronger won and a weaker dollar enhance foreign investor appeal seems to be breaking down in this scenario.

Park Sang-hyun from iM Securities notes that the current market conditions, with a focus on a few large export companies, may not benefit from the strong won, leading to reduced overall market strength.

Short-Term Outlook and Foreign Investment

In the short term, experts suggest that the Korean stock market is caught in a dilemma, influenced by both domestic and international factors.

The Bank of Korea's delay in rate cuts due to domestic financial instability may prevent the Korean stock market from benefiting fully from global liquidity increases.

However, there is speculation that if the U.S. jobs report stabilizes and expectations for a significant rate cut (a 'big cut') increase, the won could appreciate further, potentially bringing the exchange rate to around 1200 won per dollar by year-end.

Foreign investors are currently less inclined to invest in the Korean stock market, as indicated by recent selling trends.

The recent drop in foreign investment highlights a lack of clear buying signals and market momentum.

Potential Sector Shifts and Future Projections

Despite the current challenges, there is potential for a shift in market leadership toward the biotechnology sector. Recent stock movements suggest that biotech companies, like Alteogen and Samsung Biologics, could become prominent players.

Analysts believe that stable earnings and strong research and development capabilities in biotech firms could attract investor interest, especially if the market dynamics shift favorably.

Kim Hye-min from KB Securities highlights that the biotech sector might see increased attention, with companies such as Samsung Biologics and Celltrion expected to perform well.

The focus may shift to companies with solid performance and R&D capabilities as the market evolves.

3 Line Summary for You

South Korea’s stock market has underperformed globally following the U.S. Fed's rate cut signals, with the KOSPI and KOSDAQ indices showing notable declines. The rapid appreciation of the Korean won against the dollar is raising concerns about its impact on export-heavy sectors. Experts are wary of the potential negative effects on company earnings and are closely watching sector shifts, particularly towards biotechnology.

Starting Google Play App Distribution! "Tester Share" for Recruiting 20 Testers for a Closed Test.

Tester Share [테스터쉐어] - Google Play 앱

Tester Share로 Google Play 앱 등록을 단순화하세요.

play.google.com