The South Korean economy is currently trapped in a "debt trap," struggling to find a way out. While the global economy has been gradually recovering from the COVID-19 pandemic and reducing debt levels, South Korea has been an outlier, with household, corporate, and government debt levels surging. In this situation, the Yoon administration claims to be managing household and national debt well, often blaming the previous government for the current issues. But is this claim really true? Today, we'll dive into the Yoon administration's debt management practices and reveal the reality behind their claims.

1. South Korea's Debt Situation: A Lone Reversal

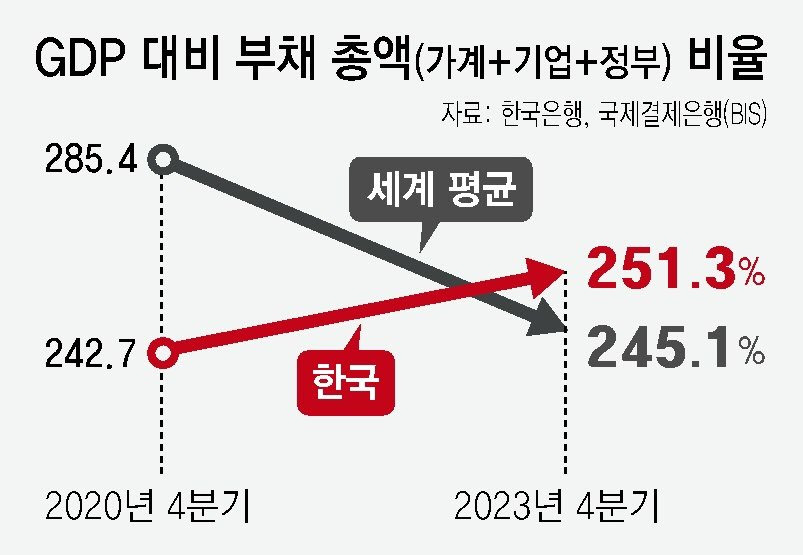

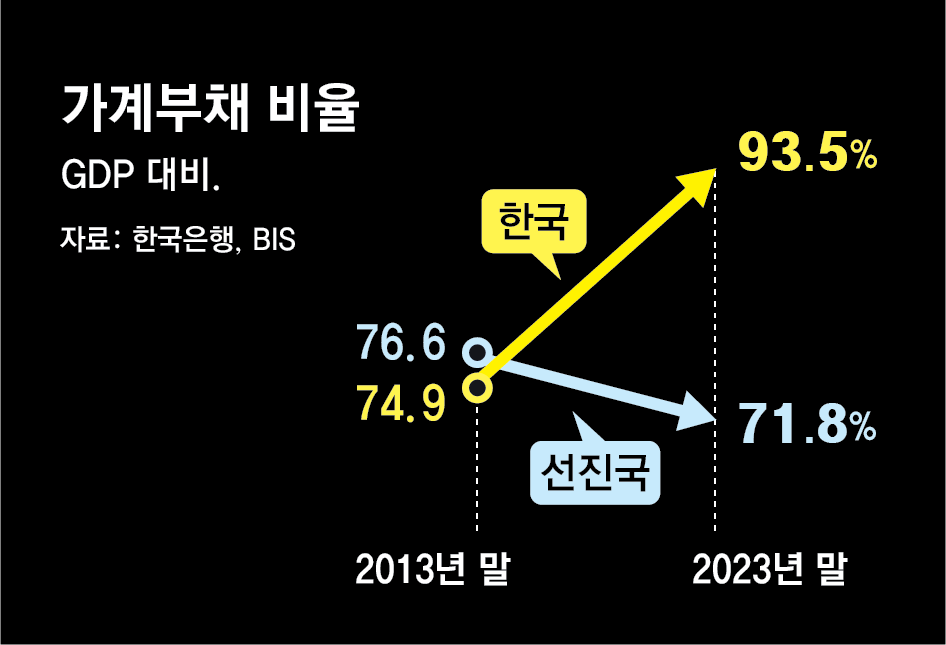

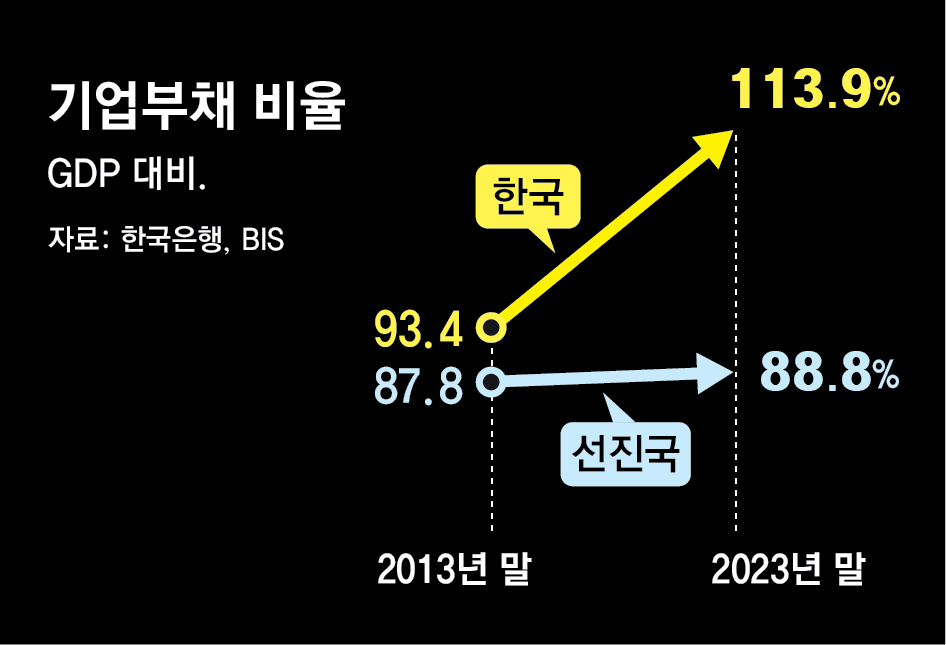

According to recent data from the Bank of Korea and the Bank for International Settlements (BIS), South Korea's debt-to-GDP ratio for households, corporations, and the government has surged to 251.3%. This is an increase from 242.7% during the COVID-19 period, highlighting how South Korea is diverging from the global trend of reducing debt. While the global average debt-to-GDP ratio has decreased from 285.4% to 245.1%, South Korea's debt has continued to grow. This stark contrast with other developed countries suggests that South Korea has failed in its debt management.

2. The Yoon Administration's Debt Management Claims: Are They Justified?

The Yoon administration asserts that it is "carefully managing the household debt ratio," comparing its performance favorably against the previous government. However, the reality is that the debt-to-GDP ratio remains high, indicating that debt management has not been effectively implemented.

President Yoon's comment about people being "slaves to the banks" ignited a surge in household loans. In response, banks, pressured by the administration, introduced measures under the guise of "shared finance," leading to a less-than-expected increase in mortgage rates. This government intervention undermined the Bank of Korea's monetary tightening policy, fueling further debt growth. Thus, the administration's market interventions and misguided financial policies have exacerbated the debt problem.

3. Comparison with the Previous Government: The True Face of the Yoon Administration

The Yoon administration often blames the previous government for the rise in national debt, claiming that its debt management is comparatively better. However, such comparisons are misleading. While it's true that debt surged during the Moon administration, this was due to necessary measures to mitigate the economic impact of COVID-19. In contrast, the Yoon administration, despite entering a period of economic recovery, has failed to reduce debt effectively and has instead implemented policies that have further increased it.

The government's unilateral support measures have led to a sharp increase in debt for small business owners and SMEs, while unrealistic policies such as freezing public utility rates have worsened national debt. The failure of the Yoon administration's debt management can be attributed to its policies being more focused on short-term popularity rather than addressing the root causes of the debt issue.

As South Korea's economy remains mired in debt, the Yoon administration continues to shift blame to the previous government, attempting to avoid responsibility. However, this approach is merely an attempt to deceive the public. The debt issue requires a long-term approach, with policies grounded in reality. It is time for the people to critically evaluate whether the Yoon administration has the will and capability to resolve these issues.

3 line summary for you

- South Korea's debt has increased since COVID-19, unlike other developed countries.

- The Yoon administration blames the previous government for rising debt, but their management isn't effective.

- Addressing the debt issue requires fundamental solutions, not short-term fixes.

공감과 댓글은 저에게 큰 힘이 됩니다.

나비일기장 [수발일기장] - Google Play 앱

수형자 수발가족및 수발인을 위한 일기장으로 수형생활시기에 따른 정보를 얻을 수 있습니다.

play.google.com

Tester Share [테스터쉐어] - Google Play 앱

Tester Share로 Google Play 앱 등록을 단순화하세요.

play.google.com